Investing is one of those things in life people know they should start doing — but never get around to actually doing it.

And … why? Especially since there are so many reasons to get started:

- Retirement. The most obvious reason you should start investing. With retirement vehicles like 401ks and Roth IRAs giving you lucrative tax advantages, you can rest easy knowing you’ll be set up for your future.

- Generate income. If you’re willing to get really into the weeds of investing, you can treat it like another source of income (but not your only source).

- It’s easy to do. When you couple investing with automated systems, you won’t have to worry about manually investing money each month. This will save you time you can spend on ways to generate even more income.

That’s why I want to show you how you can get started investing for beginners. The best part is you don’t need that much money either. In fact, you can start investing today with just $50.

Let’s dive in and find out how.

Investing for beginners: The Ladder of Personal Finance

There are five steps you should take to invest.

Each step builds on the previous one, so when you finish the first, go on to the second. If you can’t get to the fifth step, don’t worry. You can still feel great since most people never even get to the first step.

Here’s how it works:

- Rung #1: 401k. Each month you should be contributing as much as you need to in order to get the most out of your company’s 401k match. That means if your company offers a 5% match, you should be contributing AT LEAST 5% of your monthly income to your 401k each month.

- Rung #2: Your debt. Once you’ve committed yourself to contributing at least the employer match for your 401k, you need to make sure you don’t have any debt. If you don’t, great! If you do, that’s okay. You can check out my system on eliminating debt fast to help you.

- Rung #3: Roth IRA. Once you’ve started contributing to your 401k and eliminated your debt, you can start investing into a Roth IRA. Unlike your 401k, this investment account allows you to invest after-tax money and you collect no taxes on the earnings. As of writing this, you can contribute up to $5,500 / year.

- Rung #4: Max out 401k. If you have money left over, go back to your 401k and contribute as much as possible to it (this is above and beyond the employer match). You can contribute up to $18,000/year on your 401k if you’re under 50. So you should have no issue continuing to invest in your 401k.

- Rung #5: Non-retirement account. If you have money left, open a regular non-retirement account and put as much as possible there. Also pay extra on any mortgage debt you have, and consider investing in yourself — whether it’s starting a side hustle or getting an additional degree, there’s often no better investment than your own career.

The Ladder of Personal Finance is pretty handy when considering what to prioritize when it comes to your investments. For more, check out my less-than-3-minute video where I explain it.

This system shows you where you should be investing your money. Now I want to take a deeper look into a few of these rungs as well as show you a system to automate it all.

401k: Free money from your employer

A 401k is one of the most powerful investment vehicles at your disposal.

Here’s how it works: Each time you get your paycheck, a percentage of your pay is taken out and put into your 401k pre-tax. This means you’ll only pay taxes on it after you withdraw your contributions when you retire.

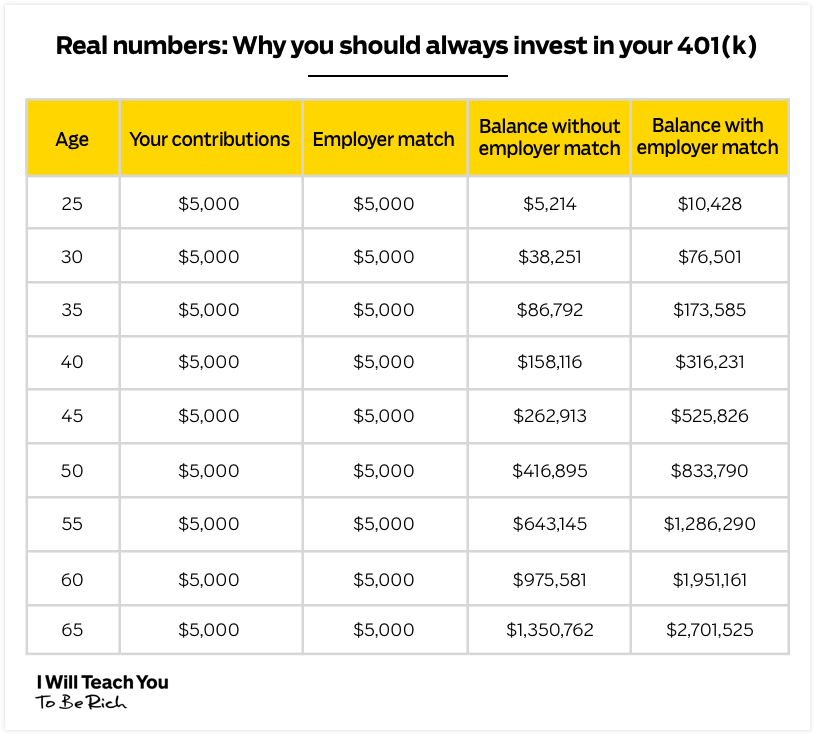

Often times, your employer will match your contributions up to a certain percentage.

For example, imagine you make $150,000 / year. Your company offers 3% matching with their 401k plan. If you invested 3% of your salary (around $5,000) into your 401k, your company would match your amount — effectively doubling your investment.

Here’s a graph showcasing this:

This, my friends, is free money (aka the best kind of money).

Not all companies offer a matching plan — but it’s rare to find one that doesn’t. If your company offers a match you should at least invest enough to take full advantage of it.

Where’s my money going?

You have the option to choose your investments when you put money into a 401k. However, most companies also give you the option to entrust your money with a professional investing company. They’ll give you a variety of investment options to choose from and can help answer any questions you have about your 401k.

The other great thing about 401ks is how easy they are for you to set up. You just have to opt in when your company’s HR department offers it. They’ll withdraw only as much as you want them to invest from your paycheck.

When do I get my money?

You can take money out of your 401k when you turn 59 ½ years old. This is the beginning of the federally recognized retirement age.

Of course you CAN take money out earlier — but Uncle Sam is going to hit you with a 10% federal penalty on your funds along with the taxes you have to pay on the amount you withdraw.

That’s why it’s so important to keep your money in your 401k until you retire.

If you should ever decide to leave your company, your money comes with you! For more on 401ks, be sure to check out my article on how the account is the best way to grow your money.

Roth IRA: The best long-term investment

Further down the ladder is the Roth IRA. This is another vehicle for long-term investing.

Unlike a 401k, a Roth IRA leverages after-tax money to give you an even better deal. This means you put already taxed income into investments such as stocks or bonds and pay no money when you withdraw it.

When saving for retirement, your greatest advantage is time. You have time to weather the bumps in the market. And over years, those tax-free gains are an amazing deal.

Your employer won’t offer you a Roth IRA. To get one, you’ll have to go through a broker — of which there are a LOT.

There are a lot of elements that can determine your decision, including minimum investment fees and stock options.

A few brokers we suggest are Charles Schwab, Vanguard (this is the one I use), and E*TRADE.

NOTE: Most brokers require a minimum amount for opening a Roth IRA. However, they might waive the minimum if you set up a regular automatic investment plan.

As of 2018, the yearly maximum investment for a Roth IRA is $5,500. This amount changes often though so be sure to check out the IRS contribution limits page to keep updated.

Where’s my money going?

Once your account is set up, you’ll have to actually invest the money.

Let me say that again, once you set up the account and put money into it, you still need to invest your money.

If you don’t purchase stocks, bonds, ETFs, or whatever else, your money will just be sitting in a glorified savings account not accruing any substantial amount of interest.

My suggestion for what you should invest in? An index fund that tracks the S&P 500. The S&P 500 averages a return of 10% and is managed with barely any fees.

For more, read our introductory articles on stocks and bonds to gain a better understanding of your options. I created a video that’ll show you exactly how to choose a Roth IRA.

When do I get my money?

Like your 401k, you’re expected to treat this as a long-term investment vehicle. You are penalized if you withdraw your earnings before you’re 59 ½ years old.

You can, however, withdraw your principal, or the amount you actually invested from your pocket, at any time, penalty-free (most people don’t know this).

There are also exceptions for down payments on a home, funding education for you/partner/children/grandchildren, and some other emergency reasons.

But it’s still a fantastic investment to make — especially when you do it early. After all, the sooner you can invest, the more money your investment will accrue.

Asset allocation: The most important thing in investing

401ks and Roth IRAs are the baseline investment vehicles you need to have.

If you want to start dipping your toes in building your own portfolio (collection of investment assets) beyond these investment vehicles, I want to introduce you to one key concept: Asset allocation.

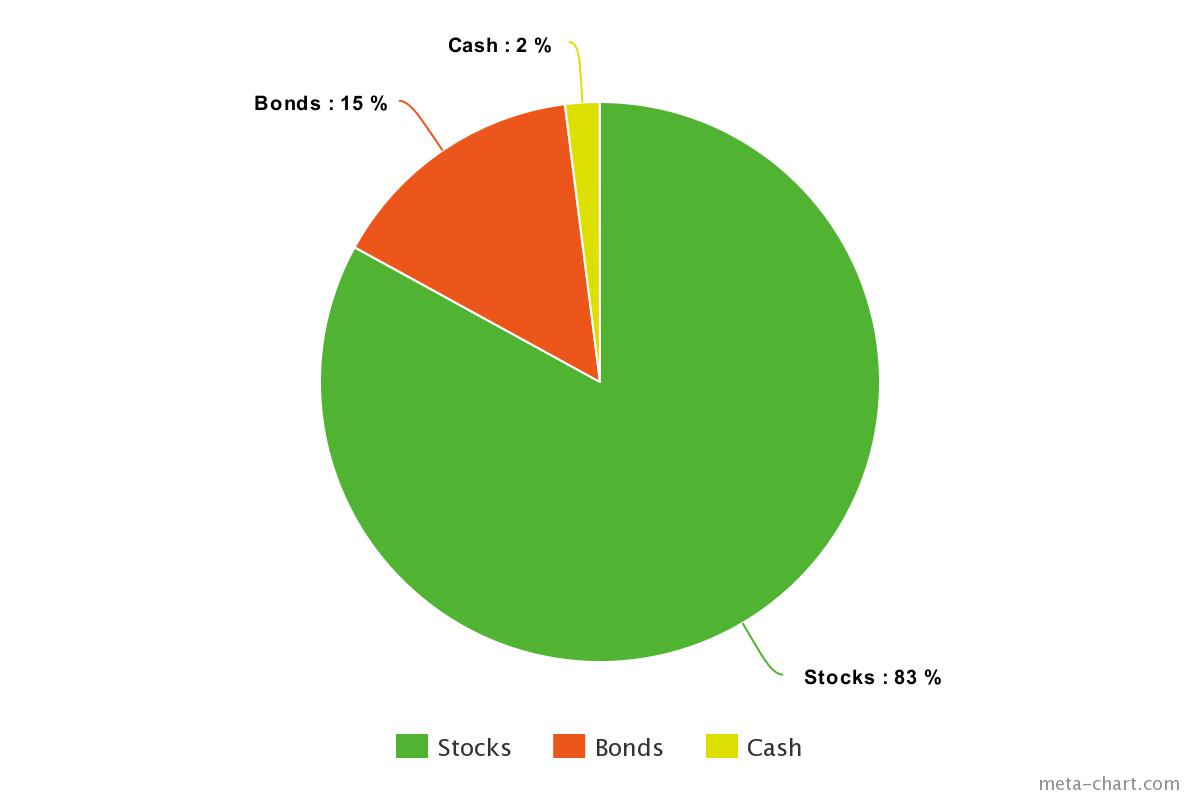

Here’s my portfolio:

Inevitably, whenever I’m teaching someone about the basics of investing, someone will pipe up with a myriad questions, like these:

- “What stocks should I buy?”

- “Is X company a good investment?”

- “Is $XX too much for this stock?”

Pump the breaks on that a bit.

Before you make an investment in any sort of stock or bond or whatever, you need to understand that’s not nearly as important as asset allocation (i.e., what your pie looks like).

When you invest, you can do so by allocating your money across different asset classes. Though there are many different kinds of asset classes, the three most common ones are:

- Stocks and mutual funds (“equities”). When you own a company’s stock, you own part of that company. These are generally considered to be “riskier” because they can grow or shrink quickly. You can diversify that risk by owning mutual funds, which are essentially baskets of stocks.

- Bonds. These are like IOUs that you get from banks. You’re lending them money in exchange for interest over a fixed amount of time. These are generally considered “safer” because they have a fixed (if modest) rate of return.

- Cash. This includes liquid money and the money that you have in your checking and savings accounts.

Investing in only one category is dangerous over the long term. This is where the all-important concept of asset allocation comes into play.

Remember it like this: Diversification is D for going deep into a category (e.g., stocks have large-cap stocks, mid-cap stocks, small-cap stocks, and international stocks).

Asset allocation is A for going across all categories (e.g., stocks, bonds, and cash).

How much you allocate in each asset class depends completely on you and your risk tolerance. For example, if you’re young and have many years before you retire, you might want to invest more in things like stocks. But if you’re older and are close to retirement age, you want to hedge your bets as much as possible and go with safe investments like bonds.

You don’t want to keep all your investments in one basket. Keep your asset allocation in check by buying different types of stocks and funds to have a balanced portfolio — and then further diversifying in each of those asset classes.

A 1991 study discovered that 91.5% of the results from long-term portfolio performance came from how the investments were allocated. This means that asset allocation is CRUCIAL to how your portfolio performs.

If you want some more solid examples of portfolio mixes, check out my article on asset allocation and diversification.

Stocks and CDs and bonds — oh my!

If you want to start getting into the weeds, there are a ton of different asset classes you can choose from and even more variety in individual investments you can make.

If you want to learn more about some of these investment options, be sure to check out my resources below:

For now, I want to show you a system that’ll allow you to invest passively — saving you time and energy.

Automate your system

Automating your personal finances helps you control your finances by putting in place a system that works passively.

This means that instead of worrying about how much you have to spend each month or manually saving and investing, you can just set it all up once and only worry about it a few hours a year.

And it’s simple:

Step 1: Have your bills sent to you on the first of the month

Call up all the companies that bill you (e.g., credit card, electric, water, cable) and have them bill on the 1st. This lets you know exactly when you’re going to be billed so you’re never confused by a surprise gas bill again.

Of course, this is assuming you’re being paid on the first of the month. If not, you can adjust the day accordingly.

Step 2: Set up your 401k

You should have your 401k set up so that your money is being invested before it even arrives in your checking account.

Remember to contribute at least enough to collect on your employer match.

Step 3: Automate your checking account

Once your paycheck actually arrives into your checking account, the money will now go into four buckets:

- Roth IRA: Remember, you’re going to want to max it out as much as possible, so if you can contribute enough to hit $5,500 / year (or $458.33 / month), do so.

- Savings account: Here is where you save for mid- to long-term money goals like your wedding, vacation, or down payment on your house. Many banks provide the option to create smaller sub-accounts in your normal savings account — perfect for goal setting.

- Credit card: Make automatic payments for recurring services like Netflix, Blue Apron, and gym memberships using your credit card. Also, if you’re maxing out your 401k and Roth IRA, you’re going to have plenty of guilt-free spending money in here for things like the occasional night out or fun purchases you want to make.

Log into your credit card’s website and set up automatic payments with your checking account so your credit card bill is paid off each month. You can rest assured that you will have enough money in your checking because you’ve already set up automatic payments with everything else.

- Misc. bills: These are for bills that can’t be paid off with a credit card such as rent, electric, water, and gas.

Set it up so that your checking account automatically sends funds to these four areas on your bank’s website — or you can just call your bank and have them do it for you. Or you could go to the bank in person, sort out your accounts, and make a new friend.

For a more detailed explanation, you can check out my 12-minute video on how to automate your finances here.

Master your personal finances today

If you want even more actionable tactics to help you manage AND make more money, you’re in luck. I wrote a FREE guide that goes into detail on how you can get started doing just that.

Join the hundreds of thousands of people who have read it and benefitted from it already by entering your information below to receive a PDF copy of the guide.

When you’re done, read it, apply the lessons, and shoot me an email with your successes — I read every email.

Yes, send me the Ultimate Guide to Personal Finance

Click here to see the full story